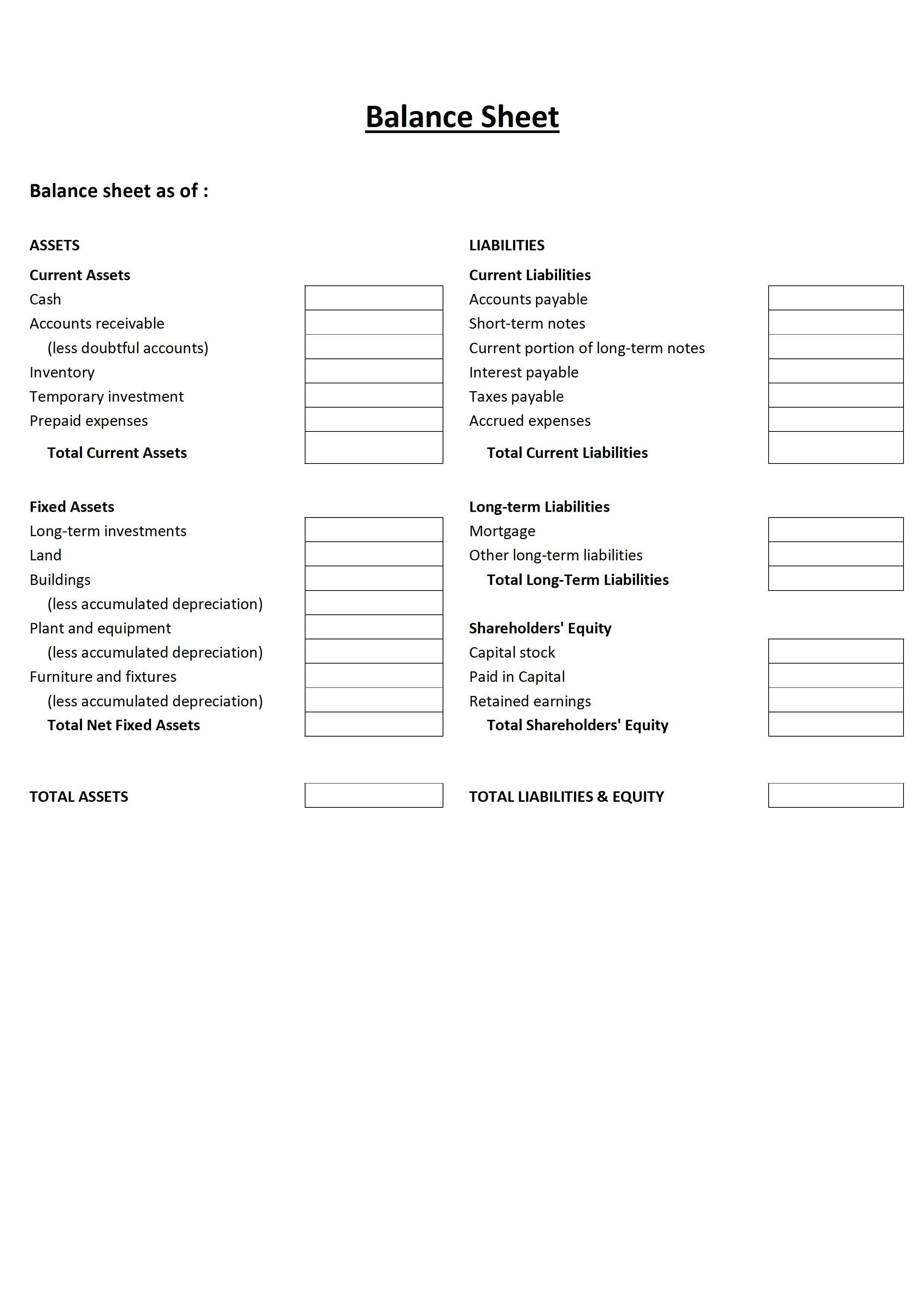

Just like looking through an old family photo book, looking at old balance sheets gives you a history of what the company looked like back on those dates. Let’s look at each of the balance sheet accounts and how they are reported. In both formats, assets are categorized into current and long-term assets.

Activity Ratios

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. A company should make estimates and reflect their best guess as a part of the balance sheet if they do not know which receivables a company is likely actually to receive. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts.

Return On Assets: What It Is and How to Calculate

- Long-term assets are critical for supporting the company’s ongoing operations, enhancing competitiveness, and generating future revenue and profitability.

- Included among these obligations are such things as long-term leases, traditional business financing loans, and company bond issues.

- Lenders will factor them into their decisions when doing risk management for credit.

- He may want to take a look at his inventory, and see what he can liquidate.

- It’s not uncommon for a balance sheet to take a few weeks to prepare after the reporting period has ended.

Check out our balance sheet software to simplify your financial analysis. It’s important to note that this balance sheet example is formatted according to International Financial Reporting Standards (IFRS), which companies outside the United States follow. If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP). Current and non-current assets should both be subtotaled, and then totaled together.

Shareholder equity

As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, hence the name.

Accurate and up-to-date balance sheets are essential for tax filings and other legal obligations. For many businesses, especially smaller ones, preparing and reviewing the balance sheet every month is a common practice. This regularity allows you to monitor short-term financial fluctuations and quickly identify emerging issues. According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity). Familiarity with your balance sheet will give you an under-the-hood look at company finances.

These documents present financial data about a company efficiently and allow analysts and investors to assess a company’s overall profitability and financial health. Financing liabilities are debt obligations produced when a company raises cash. Operating liabilities are obligations a company incurs during the process of conducting its normal business practices.

This may include accounts payables, rent and utility payments, current debts or notes payables, current portion of long-term debt, and other accrued expenses. Analyzing the mix of debt and equity on the how to pitch a business idea in 2021 balance sheet gives you insight into your business’s financial leverage. A higher proportion of debt may indicate higher financial risk, while a higher equity portion suggests more financial stability.

Operating liabilities include capital lease obligations and post-retirement benefit obligations to employees. A positive net worth indicates that your business’s assets exceed its liabilities, which is generally a sign of financial health and solvency. On the other hand, a negative net worth indicates that the business’s liabilities exceed its assets, which may signal financial distress and potential insolvency.

This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable. A balance sheet is a financial document that you should work on calculating regularly. If there are discrepancies, that means you’re missing important information for putting together the balance sheet. On the other hand, long-term liabilities are long-term debts like interest and bonds, pension funds and deferred tax liability. Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw.

Current assets consist of resources that will be used in the current year, while long-term assets are resources lasting longer than one year. If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP), and the order of accounts would be reversed (most liquid to least liquid). By looking at the sample balance sheet below, you can extract vital information about the health of the company being reported on. Owners’ equity, also known as shareholders’ equity, typically refers to anything that belongs to the owners of a business after any liabilities are accounted for. Just as assets are categorized as current or noncurrent, liabilities are categorized as current liabilities or noncurrent liabilities. You need to know your return on assets (ROA), a metric used by investors and owners alike.

Liabilities may also include an obligation to provide goods or services in the future. The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench.